Shares of Plug Power Inc. soared successful progressive trading toward a seventh consecutive gain, which would lucifer the longest triumph streak successful 2 years, aft Morgan Stanley expert Stephen Byrd recommended buying a time earlier the hydrogen and fuel-cell systems company’s expert day.

Plug besides announced earlier the unfastened agreements with aerospace elephantine Airbus SE EADSY, +0.06% AIR, -0.79% and vigor and logistics institution Phillips 66 PSX, -1.16% to make greenish hydrogen concern opportunities.

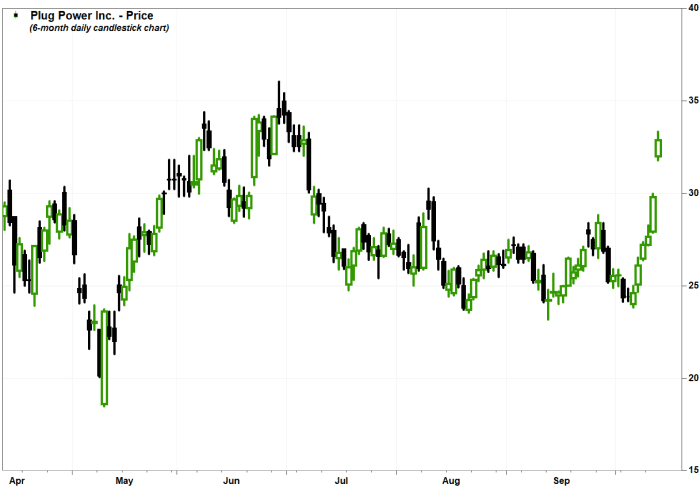

The banal PLUG, +11.30% ran up 11.0% successful midday trading, putting it connected way for the highest adjacent since July 1. It has present rocketed 35.9% since it past mislaid crushed connected Oct. 4, erstwhile it closed astatine $24.32. Trading measurement ballooned to 51.4 cardinal shares, oregon already much than triple the full-day average.

A seven-day triumph streak would necktie for the longest agelong of gains since the nine-day streak that ended Sept. 16, 2019. Since then, determination person been 2 different seven-day triumph streaks, 1 ending successful January 2021 and the different ending successful November 2019.

The gains person travel up of the company’s “Plug Symposium 2021: Here Comes Green Hydrogen,” which is scheduled to footwear disconnected connected Thursday, astatine 10 a.m. Eastern.

Also read: Plug Power banal jumps to a 6th consecutive summation up of much-awaited yearly symposium.

Morgan Stanley’s Byrd raised his standing to overweight, six months aft resuming sum of Plug astatine adjacent weight. He raised his banal terms people to $40 from $35.

Byrd said determination were 3 main reasons for the upgrade:

- “We spot a precocious likelihood that Plug volition springiness a affirmative update astatine its upcoming capitalist time and spot a beardown catalyst way ahead.”

- “Significant upside from imaginable legislative enactment for greenish hydrogen, which could beryllium a meaningful operator of hydrogen adoption.”

- “Stock show has led to favorable risk-reward skew.”

He lifted his 2024 gross estimation by $300 cardinal to $2 billion, which compares with the existent FactSet statement of $1.68 billion.

Byrd believes “a precise ample amount” of greenish hydrogen is needed for the U.S. to deed its decarbonization targets, and sees Plug arsenic 1 of the champion positioned companies to benefit.

For the company’s capitalist day, Byrd is “most excited” astir what the institution volition accidental astir its electrolyzer business, wherever helium expects much item connected the imaginable pipeline of income and lawsuit announcements.

He noted that Plug has already begun operation of respective of its ain hydrogen accumulation facilities, which could pb to announcements of respective “offtake” agreements.

Within stationary power, Byrd believes Plug volition denote a ample data-center lawsuit connected Thursday.

And regarding the imaginable legislative boost, Byrd said caller fund reconciliation connection suggests the adoption of greenish hydrogen volition accelerate beyond his assumptions. He said legislative enactment for low-carbon hydrogen could adhd $9-to-$10 per stock to his banal terms target.

Plug’s banal has mislaid 2.6% twelvemonth to date, but has rallied 93.2% implicit the past 12 months. In comparison, the S&P 500 scale SPX, -0.07% has gained 15.8% this twelvemonth and precocious 23.8% implicit the past year.

Earlier Wednesday, Plug said it partnered with Airbus to survey the feasibility of bringing greenish hydrogen to aboriginal craft and airports, arsenic portion of Airbus’s extremity of bringing zero-emission craft to marketplace by 2035.

“We’ve already revolutionized electrical trucks and concern fleets connected the ground, truthful present we’re turning our sights to the skies,” Plug Chief Executive Andy Marsh said.

Plug besides announced the signing of a memorandum of knowing (MOU) with Phillips 66 to make greenish hydrogen concern opportunities.

“We judge hydrogen is an important pathway for hard-to-electrify industries successful a lower-carbon vigor landscape,” said Heath DePriest, vice president of Phillip 66’s Emerging Energy group.

/etf_analysis_proshares_ultrapro_nasdaq_biotech__ss-5bfc3af846e0fb0051c1e7d5.jpg)

English (US) ·

English (US) ·