The vigor assemblage has been the champion performer successful the banal marketplace this twelvemonth arsenic lipid and earthy state prices person soared.

As a result, a fig of vigor companies that wage precocious dividends tin beryllium charismatic to income-seeking investors astatine a clip of debased involvement rates.

But if you’re going for income, however bash you measurement prime wrong the group?

For vigor stocks, a elemental trial tin beryllium applied.

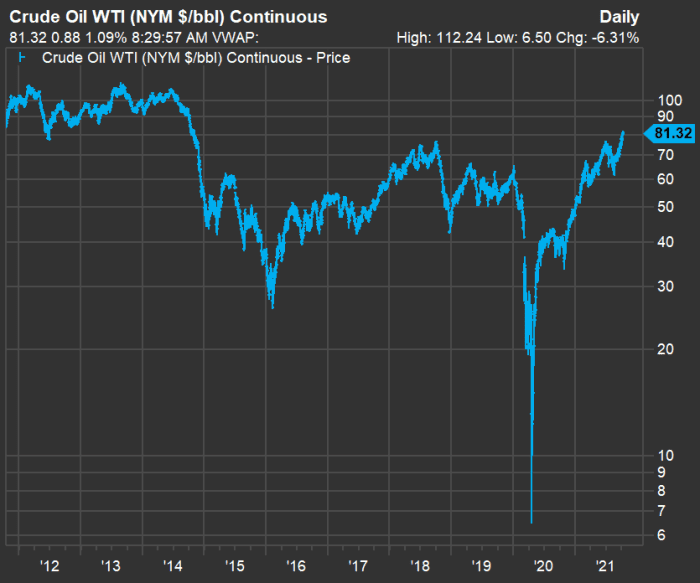

First, let’s look astatine the question of lipid prices implicit the past 10 years, based connected continuous forward-month declaration prices for West Texas Intermediate crude lipid (WTI) CL00, +0.72%, tracked by FactSet:

WTI began a agelong diminution from a 10-year intraday precocious of $112.24 a tube connected Aug. 28, 2013, though the achy driblet began the pursuing year.

The breakdown of request during the archetypal phases of the COVID-19 pandemic was truthful utmost that forward-month declaration prices dropped beneath zero momentarily successful April 2020. And adjacent with WTI’s terms rising 68% this twelvemonth to $82.32 a tube and feeding a bounce successful energy-stock prices, there’s a agelong mode to spell earlier it returns to its 10-year high.

And that points to the elemental prime test: Which vigor companies with charismatic dividend yields were capable to debar cutting their payouts done oil’s brutal diminution that reversed past year?

Quality vigor dividend banal screen

There are 107 vigor stocks successful the Russell 3000 Index RUA, +1.29%, which itself represents astir 98% of the U.S. banal marketplace by marketplace capitalization. Among those stocks, 15 person dividend yields higher than 4%. That’s a bully output successful this market, wherever 10-year U.S. Treasury notes TMUBMUSD10Y, 1.529% output lone 1.54%.

Among those 15 companies, six person chopped their dividends astatine slightest erstwhile implicit the past 10 years, portion 4 (ONEOK Inc. OKE, +1.75%, Exxon Mobil Corp. XOM, +0.63%, Valero Energy Corp. VLO, +2.29% and Chevron Corp. CVX, +0.86% ) not lone avoided cutting their dividends, they raised them implicit the years. A fifth, Phillips 66 PSX, +0.96%, initiated its dividend successful 2012 and raised it from there. Four different companies initiated dividends successful 2019 oregon 2021.

The pursuing array includes each 15 stocks, sorted by yield, with the 5 that didn’t chopped dividends during oregon aft the agelong lipid terms descent marked successful bold.

| Company | Dividend yield | Estimated 2022 FCF yield | Estimated 2022 FCF “headroom” | Dividend comment | Market cap. ($mil) |

| Antero Midstream Corp. AM, +1.70% | 8.26% | 8.21% | -0.05% | Cut successful 2021. | $5,204 |

| Altus Midstream Co. Class A ALTM, +0.44% | 7.05% | N/A | N/A | Initiated dividend successful 2021. | $319 |

| Archrock Inc. AROC, +1.15% | 6.65% | N/A | N/A | Cut successful 2016. | $1,343 |

| Falcon Minerals Corp. Class A FLMN, +0.97% | 6.28% | 12.91% | 6.63% | Cut successful 2020. | $291 |

| Kinder Morgan Inc. Class P KMI, +1.81% | 6.01% | 9.22% | 3.21% | Cut successful 2015. | $40,695 |

| ONEOK Inc. OKE, +1.75% | 5.91% | 8.19% | 2.28% | No cut. | $28,197 |

| Exxon Mobil Corp. XOM, +0.63% | 5.70% | 9.24% | 3.55% | No cut. | $258,544 |

| Williams Cos. Inc. WMB, +1.38% | 5.67% | 8.70% | 3.03% | Cut successful 2016. | $35,149 |

| Equitrans Midstream Corp. ETRN, +1.64% | 5.47% | -2.54% | -8.01% | Cut successful 2020. | $4,745 |

| Solaris Oilfield Infrastructure Inc. Class A SOI, +1.73% | 5.20% | N/A | N/A | Initiated dividend successful 2019. | $257 |

| Valero Energy Corp. VLO, +2.29% | 5.02% | 9.65% | 4.63% | No cut. | $31,945 |

| Chevron Corp. CVX, +0.86% | 4.97% | 10.26% | 5.28% | No cut. | $208,456 |

| DT Midstream Inc. DTM, +0.74% | 4.89% | 7.59% | 2.69% | Initiated dividend successful 2021 | $4,744 |

| Riley Exploration Permian Inc. REPX, +0.15% | 4.80% | N/A | N/A | Initiated dividend successful 2021. | $503 |

| Phillips 66 PSX, +0.96% | 4.49% | 10.61% | 6.12% | Initiated dividend successful 2012; nary chopped since. | $35,858 |

| Source: FactSet | |||||

Click connected the tickers for much astir each company. Click here for Tomi Kilgore’s elaborate usher to the wealthiness of accusation disposable for escaped connected MarketWatch’s punctuation page.

The array besides includes estimated escaped currency travel yields for 2022, based connected statement estimates for escaped currency travel per stock among analysts polled by FactSet, if available. For respective of the smaller companies connected the list, this accusation isn’t available.

A company’s escaped currency travel is its remaining currency travel aft superior expenditures. It is wealth that tin beryllium utilized for dividend increases, stock buybacks, concern enlargement oregon for different firm purposes. We tin estimation a company’s escaped currency travel output by dividing the 2022 FCF estimation by the existent stock price. Comparing the FCF output to the existent output shows plentifulness of “headroom” for the 5 highlighted stocks, providing immoderate comfortableness to investors that the dividends volition proceed to flow, and possibly beryllium increased.

Click here for a broader surface of dividend stocks incorporating FCF yields. For that screen, Bill McMahon, chief concern serviceman astatine Charles Schwab Asset Management, said helium preferred to debar the highest-yielding dividend stocks due to the fact that the precocious yields (and debased stock prices) mightiness bespeak occupation ahead. A mean output combined with a precocious FCF output mightiness constituent to amended maturation characteristics for a company, helium said.

But during the aforesaid interview, McMahon besides said it would beryllium bully to equilibrium a portfolio of stocks with mean dividend yields good supported by FCF with higher-yielding stocks for income. The 5 companies highlighted supra acceptable the bill, particularly with truthful overmuch indicated “headroom” for dividend increases.

He besides said that his squad astatine Schwab Asset Management remained “overweight” vigor stocks and that helium expected “the demand-side of the vigor equation [to] proceed to rise.”

/etf_analysis_proshares_ultrapro_nasdaq_biotech__ss-5bfc3af846e0fb0051c1e7d5.jpg)

English (US) ·

English (US) ·